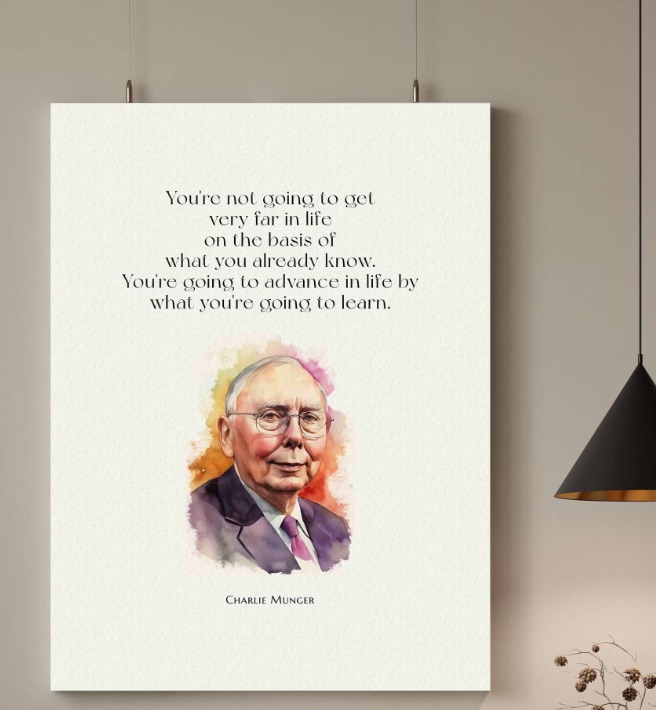

Tenho alguns poucos ídolos na vida. Charlie Munger, que faleceu hoje aos 99 anos, era um deles.

Embora menos famoso e bilionário que Warren Buffet, seu sócio e parceiro de décadas, Charlie foi o cérebro por trás do conceito de “value investing”, a escolha de ações sendo negociadas abaixo do seu valor intrínseco ou “book value”. “Value investors” buscam ações que entendem estarem subestimadas pelo mercado, a partir dos seus fundamentos. Eles acreditam que o mercado sobrereaje a boas e más notícias, resultando em movimentos de preço que não refletem os fundamentos de valor da companhia no longo prazo. Tal reação excessiva oferece uma boa oportunidade de lucro ao se comprar ações a preços descontados.

Muito além das estratégias no mercado financeiro, o verdadeiro impacto de Charlie sobre mim esteve no volume e profundidade das suas reflexões sobre a vida, a arte de investir, seus insights repletos de aprendizado profundo. Ele sempre foi um frasista enormemente hábil, capaz de sintetizar em poucas palavras um profundo conhecimento, sempre com enorme bom humor.

Eu me lembro quando Buffet, numa palestra em Harvard, compartilhou uma frase que Charlie disse para ele ao discutirem uma oportunidade de investimento:

“Warren, think more about it. You are smart. And I am right“.

Eu revisito sempre seus livros e quotes, que têm o dom de serem eternos e atemporais. Algumas deliciosas para ilustrar sua perspicácia:

“The best thing a human being can do is to help another human being know more.”

“Acquire worldly wisdom and adjust your behavior accordingly. If you are new, behavior gives you a little temporary unpopularity with your peer group then to hell with them.”

“In my whole life, I have known no wise people (over a broad subject matter area) who did not read all the time – none, zero.”

“It is not given to human beings to have such talent that they can just know everything about everything all the time. However, it is given to human beings who work hard at it. Who look and sift the world for a mispriced bet – that they can occasionally find one.”

“Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.”

“Acknowledging what you do not know is the dawning of wisdom.”

“Recognize reality even when you do not like it – especially when you don’t like it.”

“Remember that reputation and integrity are your most valuable assets – and can be lost in a heartbeat.”

“I think records of accomplishment are very important. If you start early trying to have a perfect one in some simple thing like honesty, you are well on your way to success in this world.”

“We try more to profit from always remembering the obvious than from grasping the esoteric.”

“Intelligent people make decisions based on opportunity costs.”

“If all you succeed in doing in life is getting rich by buying little pieces of paper, it is a failed life. Life is more than being shrewd in wealth accumulation.”

“Someone will always be getting richer faster than you. This is not a tragedy.”

“You must have the confidence to override people with more credentials than you whose cognition is impaired by incentive-caused bias or some similar psychological force that is obviously present. Nevertheless, there are also cases where you have to recognize that you have no wisdom to add – and that your best course is to trust some expert.”

“The safest way to try to get what you want is to try to deserve what you want. It is such a simple idea. It is the golden rule. You want to deliver to the world what you would buy if you were on the other end.”

“I am not entitled to have an opinion unless I can state the arguments against my position better than the people who are in opposition. I think that I am qualified to speak only when I have reached that state.”

“Thinking that what is good for you is good for the wider civilization, and rationalizing foolish or evil conduct, based on your subconscious tendency to serve yourself, is a terrible way to think.”

“Avoid working directly under somebody you do not admire and don’t want to be like.”

“Intense interest in any subject is indispensable if you are really going to excel in it.”

“Never, ever, think about something else when you should be thinking about the power of incentives.”

“Fixable but unfixed bad performance is bad character and tends to create more of it, causing more damage to the excuse giver with each tolerated instance.”

E, a minha favorita:

“Above all, never fool yourself, and remember that you are the easiest person to fool.”

Recomendo em particular a versão revisada dele, descrita neste blog post sobre seu texto seminal sobre a “psicologia de juiz errôneo humano” (The Psicology of Human Misdjudgement). Apesar de terem investidores como pano de fundo, os insights sobre comportamento humano, racionalidadee (e irracionalidade!), padrões de erros de pensamento e tantos outros tesouro do conhecimento vão muito além do universo das finanças.

Charlie morreu hoje 😢. No release da Berkshire, duas infos deixam indícios de um homem que levou uma vida plena e, em particular, organizada. A nota diz que Munger morreu “peacefully with his family”, e finaliza: “Family will handle all affairs pursuant to Charlie’s instruction”.

Um homem sábio sabe viver – e sabe morrer.

Rest in peace, Charlie. ❤️